How to Use 0% Balance Transfer Credit Cards to Save Money

Balance Transfer Credit Cards have emerged as a strategic tool for those eager to alleviate this burden. By utilizing balance Transfer Credit Cards, individuals can benefit from reduced interest, allowing for a more efficient and manageable repayment strategy.

What are Balance Transfer Credit Cards?

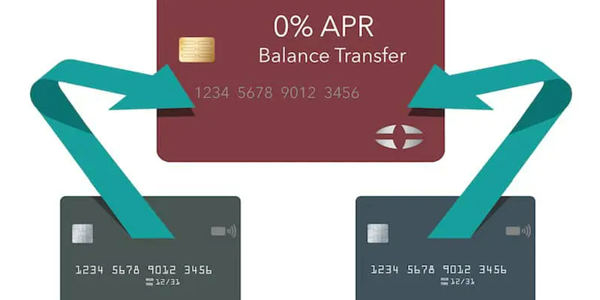

A balance transfer card is specifically designed to help consumers manage and consolidate their debts more effectively. It allows users to transfer high-interest debt from various credit cards onto a single new card, thus streamlining payment processes and providing relief from exorbitant interest charges.

The most significant advantage of these cards is that they often come with enticing introductory offers featuring 0% Annual Percentage Rates (APR) for an initial period. During this window, consumers can pay down their debt without worrying about accruing additional interest, making it easier to reduce what they owe. This consolidation simplifies multiple outstanding balances into a single payment, fostering clarity and enabling individuals to navigate their journey toward financial stability with greater ease.

Benefits of Using a Balance Transfer Credit Card

Using a balance transfer card can be a strategic move for those with high-interest credit card debt. One key advantage is the potential for lower interest rates, which can sometimes be as low as 0% for an introductory period. This allows borrowers to apply a greater portion of their payments towards the principal, thereby accelerating debt reduction. Additionally, consolidating multiple high-interest debts into a single balance transfer card simplifies monthly payments and reduces financial Stress.

Furthermore, responsible use of a balance transfer card can boost your credit score by lowering your credit utilization ratio. Transferring balances from various accounts and managing them effectively demonstrates good credit management. As debt levels drop, the relief from high-interest obligations leads to increased financial stability. These benefits not only improve your current financial situation but also pave the way to a debt-free future.

Selecting The Right Balance Transfer Card

Choosing the appropriate balance transfer card can significantly enhance your debt management experience. Start by assessing several crucial aspects:

1. Interest Rates: Look for cards offering low or 0% introductory APRs, as a lower interest rate can significantly expedite your debt repayment journey.

2. Transfer Fees: Be aware of balance transfer fees, which range from 3% to 5%. Calculating these fees against your prospective savings is essential when transferring balances.

3. Credit Score Requirements: Verify that your credit score meets the criteria set by the card issuer. Typically, a higher credit score opens the door to more favourable loan offers, although options are available for a range of credit scores.

4. Duration of the Introductory Offer: Please note the duration for which the 0% APR will be applied. A more extended promotional period provides additional time to pay off debts without incurring interest charges.

Before applying, take a moment to reflect on your financial habits and needs. Setting a clear budget that considers your capacity to repay the amount within the promotional period is wise. This thoughtful approach will help you select a balance transfer card that aligns with your financial goals.

Executing a Balance Transfer

Transferring your credit card balance is an effective strategy to take control of your debt management. Follow these essential steps to ensure a smooth transition:

1. Identify Your Balance and Rates: Begin by analyzing your current credit card statements to determine your outstanding balances and the interest rates applied. This knowledge is crucial in accurately assessing your requirements.

2. Research New Options: Seek out balance Transfer Credit Cards that boast low or 0% introductory rates. Pay close attention to the duration of these promotional rates and any associated fees that may apply.

3. Apply for the New Card: Once you have found a suitable card, complete the application process. Ensure that your credit score aligns with the lender's criteria to enhance your acceptance likelihood.

4. Request the Transfer: Once you receive approval, contact the new card issuer to initiate the transfer. Have your old card details and the total transfer amount at hand for a seamless process.

Throughout this journey, remember to continue servicing payments on your existing debts. This diligence helps maintain financial health and prevents the escalation of interest on outstanding balances.

Top 0% Balance Transfer Credit Cards

Explore these well-regarded balance Transfer Credit Cards that feature attractive benefits:

1. Chase Freedom Flex

APR: 0% for 15 months

Fees: 3% balance transfer fee

Features: 5% cash back on rotating categories and 1% on all other purchases.

2. Citi Simplicity Card

APR: 0% for 18 months

Fees: No late fees or annual fee

Features: Access to various payment tools and timely alerts.

3. Discover it Balance Transfer

APR: 0% for 18 months

Fees: 3% balance transfer fee

Features: Double cash back rewards in the first year.

4. Wells Fargo Reflect Card

APR: 0% for 18 months

Fees: No annual fee

Features: 18 months without late fees and flexible payment options.

Balance Transfer Credit Cards For Individuals With Bad Credit

For individuals with lower credit scores, here is a selection of balance Transfer Credit Cards that may fit your needs:

1. Indigo Platinum Mastercard

APR: 24.90% variable

Terms: No annual fee and a pre-qualification option to avoid hard inquiries.

2. Citi Simplicity® Card

APR: 18.99% – 26.99% variable

Terms: 0% intro APR on balance transfers for 18 months; no late fees or penalty rates.

3. Reflex Mastercard®

APR: 29.99% variable

Terms: Accessible for low credit scores; potential for increased credit limits with responsible usage.

4. Total Visa® Card

APR: 29.99%

Terms: Initial credit line of $300; designed to support credit rebuilding with responsible management.

Conclusion

Balance Transfer Credit Cards offer a viable avenue for alleviating the strain of credit card debt through lower interest rates and the consolidation of payments into more manageable amounts. As you navigate these options, consider your financial circumstances to maximize the benefits available and take a firm step towards a healthier financial future. Read on to find the best 0% balance transfer cards to save more.